Why Legal Readiness Will Define the Success of Web3 in India

Introduction

Web3 is no longer a distant concept for India. Blockchain based platforms, decentralised finance, NFTs, and token driven ecosystems already influence how value is created and exchanged. India hosts one of the world’s largest developer communities in Web3. Yet innovation alone will not determine long term success.

Legal readiness will.

The next phase of Web3 adoption in India depends on how well founders, investors, and platforms align with evolving legal frameworks. Regulatory awareness, compliance discipline, and dispute preparedness will shape which projects scale and which fail.

This article examines why legal readiness sits at the centre of India’s Web3 future.

Understanding Web3 in the Indian Context

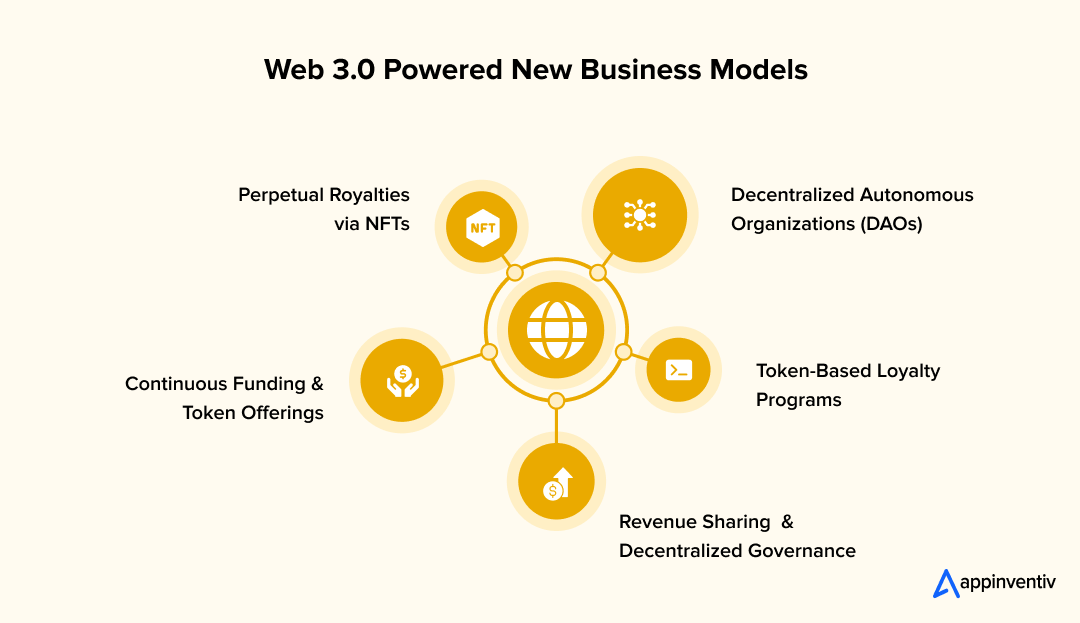

Web3 refers to decentralised digital ecosystems built on blockchain technology. It enables peer to peer transactions, token ownership, and programmable contracts.

In India, Web3 activity spans:

• Crypto exchanges and wallets

• NFT marketplaces

• Play to earn and online gaming platforms

• Decentralised finance applications

• Tokenised real world assets

While innovation moves fast, regulation moves carefully. This gap creates legal exposure for businesses operating without structured compliance planning.

India’s Regulatory Reality for Web3

India does not yet have a single Web3 or crypto law. Regulation exists through multiple statutes and authorities.

Key touchpoints include:

• Income tax and GST provisions

• Anti money laundering laws

• Data protection principles

• Consumer protection norms

• Foreign exchange regulations

This fragmented approach means Web3 entities must interpret several laws together. Legal readiness ensures compliance across all applicable regimes rather than reliance on assumptions.

Why Legal Readiness Matters More Than Speed

Many Web3 founders prioritise speed to market. This approach often ignores legal groundwork.

In India, regulatory enforcement tends to be retrospective. Authorities act after risk surfaces. Projects launched without compliance preparation face sudden freezes, notices, and reputational damage.

Legal readiness offers:

• Reduced enforcement risk

• Better investor confidence

• Sustainable scaling

• Clear governance frameworks

Web3 success in India depends less on innovation alone and more on lawful execution.

Compliance Is No Longer Optional for Web3 Platforms

The perception of Web3 as regulation free technology no longer holds.

Authorities now expect Web3 platforms to comply with:

• KYC norms

• Transaction monitoring

• User verification

• Record keeping

• Reporting obligations

Non compliant platforms face blocked banking access and enforcement scrutiny. Early compliance planning allows smoother operations and reduces business interruption.

Financial Intelligence and Reporting Obligations

India places strong emphasis on financial surveillance.

Web3 platforms handling funds, tokens, or in game assets fall within the regulatory lens. Platforms connected with gaming, rewards, or token economies face heightened scrutiny.

This makes FIU-IND registration for online gaming platforms a critical compliance step for Web3 businesses operating at scale. Failure to comply invites penalties and investigation risks.

Smart Contracts Need Legal Oversight

Smart contracts automate transactions. They do not replace legal responsibility.

Poorly drafted smart contracts can create disputes related to:

• Asset ownership

• Token issuance rights

• User obligations

• Revenue sharing

• Platform liability

Indian courts will increasingly interpret smart contracts using contract law principles. Legal vetting ensures enforceability and risk mitigation.

Web3 and Consumer Protection Concerns

User protection will remain a regulatory priority.

Issues include:

• Misleading token promotions

• Inadequate risk disclosures

• Unfair contract terms

• Platform shutdown without notice

Web3 platforms must align user interfaces and disclosures with consumer protection standards. Legal readiness ensures transparent communication and reduced dispute exposure.

Handling Fraud and Asset Recovery in Web3

Crypto fraud incidents continue to rise in India. Users face scams, wallet hacks, and unauthorised transfers.

Asset recovery remains complex due to anonymity and cross border movement. However, legal remedies exist through coordinated action involving exchanges, regulators, and courts.

Engaging a cryptocurrency recovery attorney in Delhi, India becomes crucial when victims seek tracing, freezing, and recovery of digital assets. Legal preparedness improves response time and recovery chances.

Cross Border Transactions and Foreign Exchange Laws

Web3 projects often involve global users and investors. This creates exposure under foreign exchange regulations.

Risks include:

• Unauthorised foreign investments

• Improper token sales

• Cross border payment violations

• FEMA non compliance

Legal readiness ensures proper structuring of token offerings and revenue flows to avoid enforcement action.

Investor Confidence Depends on Legal Clarity

Institutional investors increasingly evaluate legal risk before funding Web3 ventures.

They assess:

• Regulatory compliance status

• Governance structures

• Litigation exposure

• Enforcement history

Projects with clear legal frameworks attract long term capital. Those operating in grey zones struggle to raise serious funding.

The Role of Policy Evolution in Web3 Growth

India continues to engage with global policy discussions on digital assets. Future regulations may introduce:

• Licensing frameworks

• Token classification rules

• Custody norms

• Advertising standards

Web3 entities with strong legal foundations will adapt quickly. Others may face restructuring or exit.

Building Legal Readiness Into Web3 Strategy

Legal readiness should not be reactive. It must be strategic.

Key steps include:

• Early legal audits

• Compliance roadmaps

• Contract standardisation

• Regulatory engagement

• Crisis response planning

This approach transforms law from a barrier into a business enabler.

Conclusion

Web3 holds immense potential for India. Talent, innovation, and adoption already exist. What remains critical is legal readiness.

The success of Web3 in India will not depend on decentralisation alone. It will depend on how responsibly platforms operate within legal frameworks.

Founders who treat law as an ally will build resilient ecosystems. Those who ignore it will face regulatory friction.

In the coming years, legal readiness will separate sustainable Web3 ventures from short lived experiments.

Comments

Post a Comment